Bureau meeting on February 2021

15.03.2021

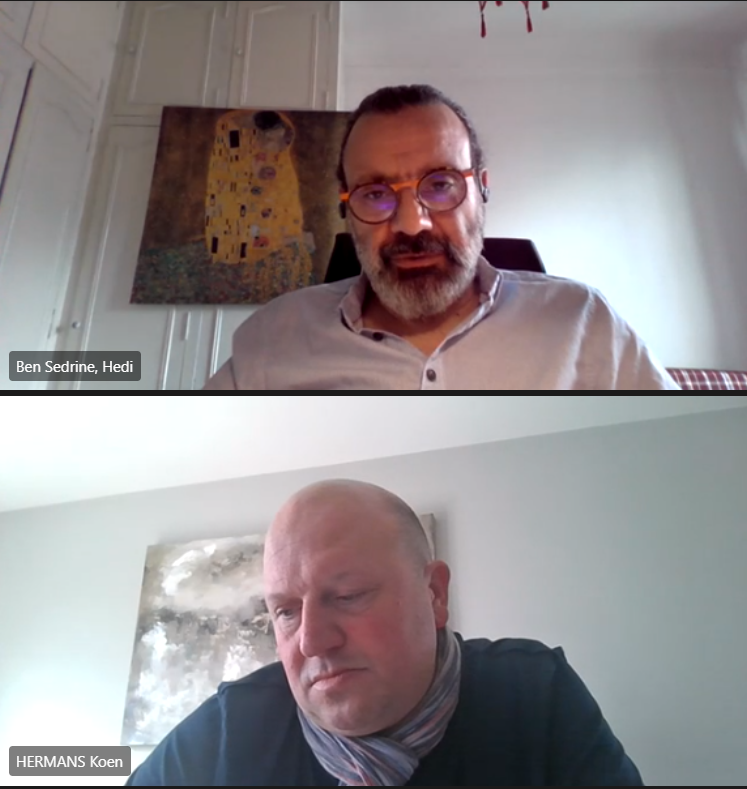

Hedi ben Sedrine, Secretary of the EWC, and Koen Hermans, Director of Social Relations for the Group, opened the monthly meeting of the EWC by welcoming the participants, still in remote mode. Koen Hermans announced the forthcoming publication of the group's results (which you can find here) before handing over to the speakers.

Harassment prevention policy in the AXA Group

Kirsty Leivers (Head of Culture, Inclusion and Diversity at the AXA Group) and Carlene Clifford (Project Development Manager) presented the project to harmonise the Group's harassment prevention policy, pointing out that no form of harassment is tolerated. The objective of this harmonisation is to make progress on the subject in all entities. This project started in 2020 and it was necessary to identify the existing policies in the different entities, to establish minimum standards, based on local legislation and to be applied worldwide by 1 May 2021. The social partners have a very important role to play on this subject of harassment as intermediaries and supporters of employees who are victims of harassment. These standards will also be imposed on third parties working for AXA, such as agents.

Presentation of Lloyd's

Sean McGovern, CEO of the UK and Lloyd's division at AXA XL, then gave a very educational presentation to the members of the Bureau on the Lloyd's market. The way it operates is very different from other markets, partly due to its origin (a pub named after its owner, Edward Lloyd's, who rented out tables to businessmen who sold insurance to ship owners who might not return to port). Sean explained the workings of this unique place in the world. This market is made up of 50 agents and 80 syndicates, which facilitates exchanges, particularly for co-insurance and risk diversification. AXA operates through two syndicates (one life and one non-life). For several years, AXA's participation in Lloyd's has been reduced, due to the group's strategy. Nevertheless, AXA wishes to remain a major player in the London market.

The impact of Brexit is not insignificant, but AXA has found the right solutions to limit this impact. Hedi ben Sedrine recalled that the UK is an important region for XL and that the subject of integration is perhaps less sensitive there because of the predominance of XL before the merger.

Bilan de l'opération Shareplan

Ombline de Tessières, head of compensation at AXA, details the results of the 27th edition of the employee share ownership plan. This plan took place in unusual market conditions, which did not allow the group to propose, through a partner bank, the leveraged offer as it was the case until now. Compared to other CAC 40 companies, AXA is in a rather good position: only 4 companies managed to maintain a leveraged offer while many others did not propose an employee share plan for 2020. Overall, the amount of employee investment has only decreased by 5%, but with disparities between countries, especially in countries where take-up of the leveraged offer was high. For the next few years, the AXA Group is considering how to make employee share ownership more attractive.

Find the notes of the meeting :